How to find the answers to the most important questions about life insurance protection.

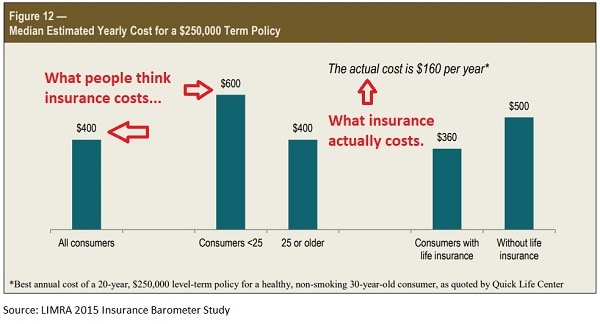

A recent survey found the average American overestimated the cost of life insurance by 300% and nearly half of millennials thought premiums were 500% more than they really were.

That's bad news considering most people say the cost of life insurance is what's keeping them from getting coverage. They think protection is wildly more expensive than it actually is and that keeps them from the policy that will help protect their family when in need.

Let's look at the facts. How much does life insurance cost and how much do you really need?

We’re building a huge community of people ready to beat debt, make more money and make their money work for them. Subscribe and join the community to create the financial future you deserve. It’s free and you’ll never miss a video.

Join the Let’s Talk Money community on YouTube!

The Most Important Questions about Life Insurance

How much is life insurance and how much do you really need? These were two of the most frequent questions I got after our last video covering insurance misconceptions.

That question about how much does life insurance cost was a big one with a study from the insurance industry finding that people on average think a policy costs three-times more than actual quotes and 44% of millennials over-estimating the cost of insurance by five-fold.

In fact, a 2015 study showed people estimated the premium for a healthy 30-year old between $400 to $1,000 a month when the actual average is closer to $13 a month.

I was as surprised as you were in our last video about those misconceptions. I didn’t even think about life insurance until my 30s but when I did, these were my two biggest questions. How much is it and how much do I really need?

That’s why I’m teaming up with Quotacy, the country’s leading broker for buying life insurance online, to get a real answer to these questions. Over these three videos, we’ll be looking at exactly how much life insurance you need, how much it costs and how to get the lowest premiums by shopping your life insurance policy online.

Quotacy has built out an online process that really takes the guesswork out of insurance. The application takes less than five minutes and then gets shopped around to 20 carriers for the best policy. In fact, you’ll be able to get estimates on your premium in seconds with their pre-application process.

The team at Quotacy works on salary instead of commission so it’s there to find you the best policy, not the one with the fattest kickback.

Click to get your instant quote and shop your policy around for the best rate

How to Find a Life Insurance Quote Online

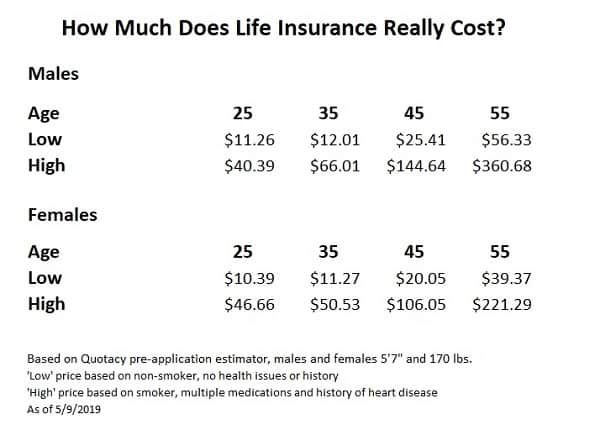

I want to look at how much insurance costs first, because honestly I think this is the most surprising. I’m going to use Quotacy’s pre-application estimator to find a high and low rate for males and females at every decade.

The estimator takes all of 30-seconds to use. You first put in how much coverage you want and the term. Then some basic health information like height, weight, whether you smoke, whether you’re on medication for blood pressure or cholesterol and any history of cancer or heart disease in your family. The resource is then going to check some of the largest carriers to estimate a premium.

So to build out this chart of how much life insurance costs for each decade, I went through the estimator 16 times. Each time I looked at a good health and poor health scenario for each decade and for males and females.

For the good health scenario, I assumed a non-smoker and no health issues or family history. For our poor health scenario, I assumed a daily smoker on medications for both blood pressure and cholesterol and a history of heart disease…so yeah, this was one unlucky sucker. For our policy, I chose $300,000 in coverage on a 15-year term life policy.

One thing I want to point out, besides the fact that these are estimates and your rate might be different, is that the rate we see in each decade is if you’re getting a new policy at that point. This is important and something we talked about in that previous video.

The rate on a term life insurance policy stays the same throughout that term. So if you get a quote for a 15-year policy, that monthly amount stays the same for those 15 years. If you get a 25-year policy, the rate stays the same for that period.

How Life Insurance Online Works

Here I am in the estimator and I’m going to spare you the full seven minutes it took to find all 16 life insurance quotes, which actually isn’t too bad when you think about it. That’s literally less than half a minute to get an estimate on life insurance and you get to see multiple quotes from some of the largest carriers.

For each of our scenarios, I used that same 15-year term life insurance policy for $300,000 coverage. I went through the good health and poor health scenarios for males and females and noted the lowest and highest estimated monthly premium.

And here we are with the finished table showing how much a 15-year term life insurance policy might cost you for $300,000 coverage. Obviously we see the younger you are, the less expensive it is to get insurance but there are a few really interesting things we see in the table.

First is that for the love of all that is, take care of your health. You can’t change a family history of health problems and it might be tough if you’re already on those medications but stop smoking and get on an exercise program. Now I don’t want all the smokers or anyone in less than perfect health out there to think these are going to be your monthly premiums. Remember, our poor health scenario for the high estimate was a daily smoker on multiple medications AND a family history of heart problems so most likely you’re going to see better numbers than this.

In fact, Quotacy specializes in that 40% of the population that isn’t in perfect health or that has special insurance needs. They have a team of brokers that can help you find that best carrier for the lowest rate no matter what your condition.

Click to find your custom pre-quote and find out how inexpensive life insurance really is now!

The table also shows the benefit of getting insured early and locking in a lower premium. For example, we see in the chart that it costs a health 45-year old male about $25.41 a month for a 15-year policy to protect their family to the age of 60. I ran the estimate again and that same individual could have gotten a 25-year term at age 35, so still protecting themselves to age 60, and locked in a rate of $20.77 a month.

What else do we see in the table. Well, it’s good to be a girl with women saving from $10 to over a thousand a year versus males when it comes to insurance. But really for both sexes, we see that life insurance really doesn’t cost that much. Even for an old-timer like myself approaching mid-40s, I can get a $300,000 policy protecting my family until I’m 60 for less than a third what it costs us to eat out at a restaurant.

How Much Life Insurance do You Need?

So now that we know about how much life insurance costs, how much do you really need? We used that $300,000 policy as an example but how do you know if that’s going to be enough…or not enough?

First, it’s important to know WHY you’re getting life insurance to understand better how much you need. Then we’ll talk about a basic rule for what kind of policy you need and some things that might mean you need more or less.

The top three reasons people give for buying life insurance is final expenses, that average seven to ten thousand dollars in burial costs, leaving something as an inheritance and protecting their family from the lost income.

On top of this though, you want to include savings and educational expenses. Yeah, that insurance policy needs to cover living expenses from your lost income but do you want your family to squeak by or wouldn’t you rather be able to help them save a little and pay for those college costs you were planning on covering?

Now the basic rule for insurance has always been about 10-times your annual income. According to the U.S. Census, a median income around 38,000 means we were just below on our example so maybe it should have been a $380,000 policy.

But you know, I hate these kind of one-size-fits all estimates. It is so easy to take a few minutes, think through just a few questions to decide how much insurance you need. This means looking at your current salary and how much you’re able to save now. If your salary is covering living expenses with savings to spare then maybe you don’t need that 10-times for a policy.

On the other hand, if you’re barely scraping by, not able to save anything for retirement or education, then you’ll probably want more than 10-times. Does your spouse work and do you want them to be able to do that if they lose your income? If so then you’ll almost definitely need more than the simple 10-times rule.

Life insurance doesn’t have to be a mystery and it’s not nearly as expensive as you might think. What’s really expensive is gambling on your family’s future when protecting them is so easy.

Quotacy makes it easy to get your pre-application quote to see how affordable life insurance can be and then the team works with you to shop your policy around. I’m leaving a link in the video description below so you can learn more so make sure you check that out.

Leave a Reply