Why using a personal loan to pay for a vacation may be a smart decision and how to get the lowest rates

I can hear the financial pundits screaming now. “Pay for a vacation with a personal loan, are you crazy?!?”

The idea of using any kind of debt for something as ‘unnecessary’ as a vacation is a cardinal sin among financial ‘experts’ but is there a perspective they’re not considering? If I can get a personal loan at a 12% rate and pay it back within a year, does it make sense?

I’m going to show you exactly why using a personal loan for a vacation is not only a smart money move but how to find a loan that works for you.

Why Using a Personal Loan to Pay for Vacation Makes Sense

So right now, rates on personal loans range from about 6% to 29% depending on your credit score and the personal loan website you use. Some sites offer lower rates to people with good credit while others specialize in helping bad credit borrowers, even if it’s at slightly higher rates.

With my credit score of 809 FICO, I applied for a $4,000 personal loan last year to take the family on a vacation and go to a financial conference. I was approved for a 36-month loan at 12% interest and payments of $132.86 per month.

If it hadn’t been for that personal loan, where would I have gotten the money?

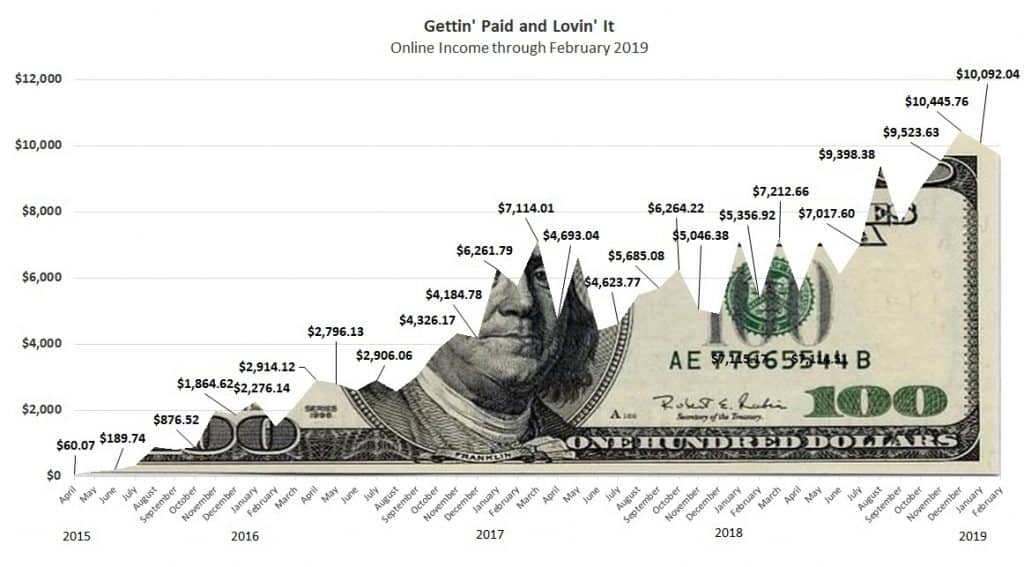

I reinvest most of my cash flow aggressively into my online business, four blogs and a YouTube channel. I’ve grown the monthly income from just $750 in 2017 to average over $10,000 a month over the first three months of 2019.

On the money I reinvest into my business, I make a 42% return on the investment. That’s well above the 12% rate I pay on personal loans so I’m certainly not going to forego business investment to pay for a vacation.

Money left over after expenses and reinvesting in the business goes into an investment account for our retirement. I have an account on M1 Finance I’m featuring in our 2019 Stock Market Challenge portfolio on the YouTube channel. In just the first four months of the challenge, the portfolio is up 24% and should break a 30% return including dividends this year.

Just the return over the first four months is already double what I would be paying on a personal loan. I’m certainly not going to take money out of investments to pay for a vacation.

Finally, there are the credit cards. Using credit to pay for a vacation would be just as bad as a loan in the eyes of most in the financial bloggers universe but I thought I’d add it here just for comparison.

I have two credit cards, a Barclays card for business expenses that puts cash back into our son’s college 529 fund and a Citi card for business expenses. Both cards charge an interest rate over 16% so definitely not using those when I could get a 12% personal loan.

So let’s look at that idea of using a personal loan to pay for the vacation. I borrowed $4,000 and paid it off in 11 months with payments of $350 a month and an extra payment at the end. I ended up paying just over $223 in interest or less than 6% of the original loan value.

For less than a couple hundred dollars, I was able to take my family on a great vacation and paid way under the loan rate by paying it off within a year.

Now I know the anti-debt people will have one more thing to say. They’ll say, you shouldn’t even be taking a vacation until you can pay with cash….yeah, right. These are the same people that will wake up one day in their 50s, realizing they rarely took a vacation or bought anything nice because they never wanted to use debt as a tool. They wasted their whole life miserably when it might have only costed them a few hundred bucks to take that annual vacation.

How to Get a Personal Loan to Pay for a Vacation

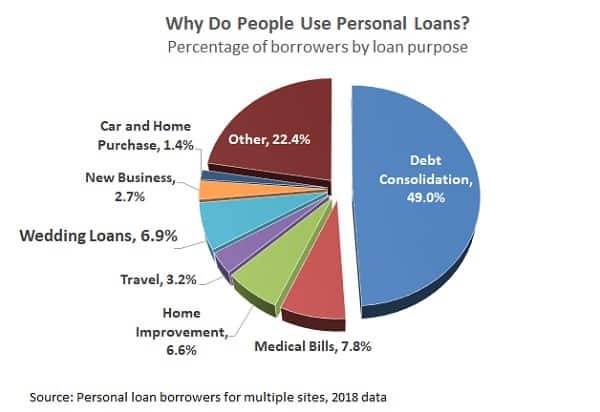

The process to get a personal loan is easy and usually takes less than a few minutes. The great thing about getting a personal loan is the money can be used for anything. While almost half of personal loan borrowers use it to repay credit cards and debt consolidation, we also see 3% use it for travel and wedding loans make up 7% of loans.

You can check the interest rate on a loan without hurting your credit score. Personal loan sites do a soft-check on your credit, similar to getting pre-approved for a credit card, to estimate your loan rate and terms. This is going to give you a rate and payment amount before you agree to the loan, all the information you need to make the right decision.

Check your rate on a loan up to $35,000 – won’t affect your credit score

If you decide to take the loan, you’ll enter your employment information and link up your bank account. Lenders ask about one-in-five borrowers to verify their income with pay stubs or employment verification so have these things ready just in case.

Once your loan is approved, it can be as little as 24 hours before the money is deposited in your bank account. Personal loans are some of the fastest loans to get because there’s no appraisal or documents needed. Loan payments will start coming out of your account automatically within a month.

You can make extra payments or pay your loan off at any time. There’s no penalty for early payment and it will help you save on interest.

Pros and Cons of Using a Peer-to-Peer Loan for Vacation

I’m not saying you should use a personal loan for anything and everything. You shouldn’t take out a loan unless you have a clear plan for paying it off. You shouldn’t borrow money you can’t afford.

If you can pay it back and you can afford the payments though, there isn’t that much difference between enjoying the money now versus waiting a year until you have the cash. Don’t be reckless with your money but you don’t have to deny yourself either. Look at the pros and cons of using a personal loan before making your own decision.

- Interest rate may be lower than other alternatives like credit cards and investments

- Personal loans help build your credit score with monthly payments

- No prepayment penalty means you can pay your loan off early and save on interest

That’s not to say there aren’t cons to using a personal loan.

- Interest rates are still higher than some other loan types like mortgages and HELOC

- If you fall behind on loan payments, it can hurt your credit score and make it hard to get another loan when you need it.

No one can make the decision for you and you shouldn’t let financial bloggers or pundits bully you into never using debt. Weigh the pros and cons and the rates available before you make a decision.

Check your rate on a personal loan – approval in seconds

Using a personal loan to pay for vacation doesn’t have to be a taboo subject. It worked for me and I think if more people looked clearly at the pros and cons, it would work for them too. Get all the information you can on using personal loans and peer-to-peer so you can make the best money decision possible.

Leave a Reply