My ten favorite personal loans sites for p2p online loans and bad credit personal loans

We’ve all been there, in a bind with bad credit and needing the cash to get through the month. I lived paycheck-to-paycheck well into my 20s before I figured out how to use credit and not get sucked into the bad credit nightmare of payday loans.

Before you pay interest rates as high as 500% on other bad credit loans, check out this list of the best personal loans sites and peer lending for people with bad credit.

This isn't just some list of peer to peer lending sites I scrapped off the internet.

I destroyed my credit score about five years ago. I mean, it was so bad I couldn't get a loan for a pack of gum. It was only by learning as much as I could about peer lending that I was able to rebuild my bad credit and keep from falling into the debt trap.

I've used four p2p lending sites for my own personal loans and talked to dozens of people that have used other sites.

So what's that mean to you?

I’ve put together this list of 10 bad credit personal loans sites to give you the choice that most people don’t have with bad credit loans. Most people don’t understand their options for online loans and end up running to the nearest pawn shop or payday lender. I know this is what happened to me and ended up destroying my credit when I had to constantly take out another loan and couldn’t pay.

It’s a pretty long list of online loans and personal loans sites but make sure you scroll down to the bottom where I talk about the best sites for specific personal loans like debt consolidation and cash advances. I also provide a p2p bad credit comparison table about half way down that makes it easier to compare peer to peer lending sites.

Reading through the list of bad credit p2p loan sites, remember a couple of things:

- The same site might not be the best for different types of loans

- Some loan sites are aggregators, they shop your loan around to get you the best offer, while other sites match you with investors

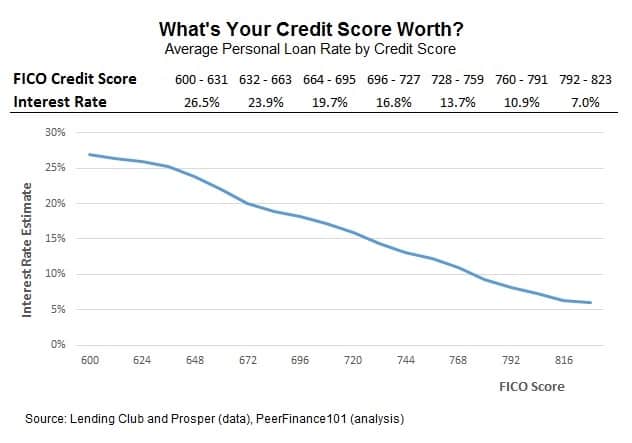

- If you can wait a couple of months to improve your credit, you’ll get a lower rate and save on interest

- Never trust no credit check loans or cash advances, the interest rates will bankrupt you

I’ve also provided a few warning signs for bad credit personal loans scams at the end of the post.

The Ultimate List of Peer to Peer Lending for Bad Credit Loans

Peer to peer lending has become the go-to source for personal loans, on any credit score. Because these loans are funded directly by investors, the rates tend to be lower and you don’t need the super-high credit score required by the banks. P2P loans are just like any other loan with a fixed rate and fixed payments.

Personal Loans.com – Most recommended Bad Credit Personal Loans Site by Readers

I like Personal Loans because it uses the old ‘shop your loan around’ way of getting the best rate available. You put your personal loan application on the site and lenders are matched with your loan according to your credit score, borrowing needs and their own loan requirements.

It’s a great way to make sure you’re getting a good deal without having to fill out a bunch of separate applications on other online loans sites.

PersonalLoans can match you with traditional bank loans if you qualify and with bad credit personal loans if your credit score is a little lower. The loan network ranges from banks to online lenders to peer lenders. You are always given the choice to select the best lender and see the interest rate for different loans. Bad credit loans are available to borrowers with credit scores as low as 580 FICO while fees and rates depend on which lender you select.

Get lenders to compete for your loan – click to check your rate today

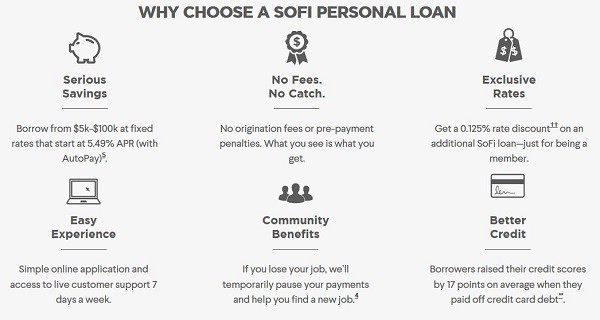

SoFi – Most Recommended Peer to Peer Lending Site for Good Credit

SoFi, formerly Social Finance, has built a name for itself refinancing student loans but has also started providing personal loans and mortgage loans. The lender is one of the largest with more than $4 billion in loans issued and growing, especially in mortgage loans since most other online lenders do not offer the loan.

Rates on personal loans are competitive with Lending Club, starting around 6%, but you might need a higher credit score to qualify. It’s one of the biggest complaints of SoFi is that they are extremely picky about which loans are funded and bad credit loans may not have a chance. Loan rates on student loans are even lower so you might try refinancing if your credit score qualifies.

One of the biggest benefits to SoFi loans is that there is no loan fee. This can save you hundreds of dollars compared to other peer lending sites. For example, a 6% loan fee will cost you $60 for every $1,000 you borrow. SoFi is also offering a $100 cash back bonus for a limited time.

Apply for a loan and $100 cash back bonus – Click to check your rate

As with all the p2p lending sites, you will want to apply on the best loan sites first even if you don’t think your credit score qualifies. The application process starts with the lender doing a ‘soft pull’ of your credit report to qualify you for a loan.

This type of loan inquiry doesn’t go on your report and doesn’t hurt your credit score so there’s really no harm in trying to get a peer loan on the lower rate sites.

Upstart – Best lending platform for no credit history and student borrowers

Upstart claims to be able to provide lower rates for bad credit borrowers with its secret underwriting model. The website bases your loan rate on credit score, work history and the school you attended. It’s been a good opportunity for people with no credit history to get a loan based on other factor, especially recent graduates.

Upstart requires a credit score of at least 620 credit score which is higher than most of the bad credit personal loan sites but the same as others like SoFi.

Upstart charges an origination fee of 0% to 8% of your loan as well as several fees for check processing, check refunds and late payments. The p2p site is a great option for graduates with no credit history but might not work as well compared to other peer loan sites for other borrowers.

Bad Credit Loans – Best personal loans website for bad credit loans

BadCreditLoans is one of the few online lenders that will approve a loan on very bad credit scores, like under 560 FICO. While I’ve seen people get a loan as low as 540 on PersonalLoans.com, it’s the exception.

BadCreditLoans is different in that it limits the amount you can borrow and terms are usually shorter compared to other websites on the list. The website approves loans for up to $5,000 but people with very bad credit scores will generally only be approved for a loan of $1,000 or less.

The lower loan amount will change how you use it but is still usually enough to get you out of a bind and get caught up on other bills. Loans are usually paid off within a year and your credit score will increase with regular payments over that time. That means you’ll be able to qualify for a larger loan and lower interest rate after the initial starter loan.

Net Credit – Best peer to peer lending for short-term installment loans

Net Credit isn't available in all states yet but is a good option for installment loans when available. Rates and fees vary by state but are generally comparable with other peer lending sites though technically Net Credit is an online lender rather than a p2p lender.

The company offers personal loans up to $10,000 and the borrowing process is one of the most transparent I've seen among personal loan sites. Net Credit uses its own unique My ScoreSaver system to determine eligibility and the rate on your loan so it won't affect your credit score when you apply.

What makes Net Credit so transparent compared to other peer lending platforms and payday loans is its free tools available. One tool, the ClearCost for Me, shows you exactly all the fees and charges on your loan. You'll pay just one simple interest on the loan and won't be hit with origination fees, application fees, early payment or late fees.

Lending Club is the world’s largest peer lending platform and really changing the way people get an online loan. It’s a little different than some of the other personal loans online because it doesn’t make loans itself but matches your loan application with investors.

Once you fill out a loan request, it goes live on the website. Interest rates are so low on other investments that investors are jumping at peer loans and most loan requests are funded within a couple of days. Lending Club is also one of the few peer to peer sites that lets anyone invest in loans.

Lending Club has recently increased the amount for personal loans up to $40,000 which is higher than the $35k max from most online lenders. The site also provides business loans of up to $350,000 but you’ll need to show your business has been in operation for a few years.

Lending Club business loan requirements:

- Two years or more in business and own at least 20% of business

- Annual sales of $50,000 or higher

- Personal credit score of 600 FICO or higher

Looking for a business loan? Check to see if you qualify for up to $350,000 from Lending Club

You’ll need a higher credit score than with some of the bad credit personal loans sites. Lending Club requires a 640 credit score or higher which still qualifies some borrowers with missed payments and other bad credit factors.

Loans are available on fixed monthly payments for three to five years. Borrowers pay an origination fee of up to 5% on the loan and interest rates range from 6.95% to 35.89% depending on credit score and amount.

Avant

Avant is one of my favorite online loans sites for bad credit peer loans. I’ve used them twice for a personal loan, once for debt consolidation and once to pay for a home remodeling project. One of the biggest complaints I hear from bad credit borrowers is the high credit score requirement on other sites like Lending Club and SoFi where you’ll need a score well into 700 for a loan.

Avant has been able to get its credit score requirement down to 580 FICO, one of the lowest I’ve seen outside of payday lenders. The site is one of the largest personal loan lenders and has made a name for itself in bad credit loans.

Avant started out not charging a loan fee on its peer loans but is now charging up to 3.75% depending on the loan. It is still about half as much as the loan fee on other peer to peer lending sites so a good deal but not like it used to be.

A lot of bad credit borrowers ask me about higher rates on Avant or other p2p sites, starting around 9% for personal loans, but don’t forget that the difference in loan fees can make up for a lot of the higher rates on peer loans. Saving $300 off the top of your peer loan with a lower fee is like saving a few percent on the rate if you pay your personal loan off within a couple of years.

P2P Lending Bad Credit Comparison

I’ve got other p2p lending sites below but they are mostly for social lending. The peer loan sites above are the ones I hear about most and the ones I’ve tried for my own personal loans. Not all p2p lending sites are created equal. Some may work best for different borrowers.

I’ve added a table for a p2p lending comparison. The comparison of peer lending sites includes rates, credit score needed and some notes on how to best use the website. Some are better for bad credit borrowers while others may offer lower rates for better credit.

| Peer to Peer Lending Site | Loan Fees | Credit Score Needed | Loan Rates | Notes |

|---|---|---|---|---|

| Personal Loans Apply Here | 5% | 580 | 9.95% to 36.0% | Best p2p loan site for bad credit borrowers. Lower credit score and three options including peer loans, bank loans and personal loans. |

| SoFi Loans Apply Here | No Fee | Not available but higher than most, around 680 FICO | 5.99% to 16.49% (fixed rate) 5.74% to 14.6% (variable rate) | Special discounts for variable rate loans. Offering $100 cash back on peer loans. |

| Upstart Apply Here | 1% to 6% | 620 | 6.25% to 30.0% | Best peer loans for graduates and no credit history. |

| BadCreditLoans Apply Here | No Fees | 520 | Vary by State | No fees and lowest credit requirements for lenders |

| Lending Club Apply Here | 1% to 6% | 640 | 6.95% to 35.89% | Low rates on p2p loans for good credit borrowers. |

Best Social Lending for Bad Credit

Social lending is a little different than peer to peer lending though there are also similarities. Some of the social lending sites below will require you to reach out to friends and family for the loans and the website may not even have its own lenders. That can be a problem for a lot of bad credit borrowers but the tradeoff is that rates might be lower.

Of the p2p social lending sites, I’ve only tried Kiva but have talked to people that used some of the other sites. Your first choice might still be some of the real peer lending sites above but check out these as well.

KIVA

KIVA was the world’s first micro-lending social website, working with almost 300 lenders worldwide for business loans to low-income and poor credit borrowers. Most of the loans have a social cause component so you won’t be able to use them for a personal loan.

I like the site because of its crowdfunding-like model where you can raise money for your cause without having to take out a loan. Many of the loan requests are still funded by lenders so it’s more of a hybrid online loans site.

ZimpleMoney

ZimpleMoney is an interesting online lender because it uses a crowdfunding model to get your loan funded. Borrowers fill out a loan application and then invite friends and family to review the loan. The online loan platform manages the payments so you don’t have to worry about handing the money to each person that helped fund your loan.

The fact that you’re personally asking people to fund your loan request may make it a good choice for bad credit personal loans. You can set the interest rate you’re willing to pay so you might not have to pay as much as you would with other bad credit loans on the list. Your FICO credit score isn’t an issue either.

The problem I have with Zimple is that you have to pay to post your loan on the site. There’s no origination fee so the basic $27 fee might end up being lower than the fee you pay on your loan on another site, but there’s no guarantee that family will want to fund your loan. I’m also not wild about having to ask friends and family to fund a personal loan.

PeerForm

I interviewed Gregg Schoenberg, executive chairman at Peerform, last year about the new online loans platform. Peerform accepts borrowers with a credit score of 600 or higher which is lower than other peer lending platforms though maybe not low enough to qualify as bad credit personal loans. Rates tend to be a little higher compared to other peer loans sites from 7% to 28% for poor credit borrowers but still much lower compared to payday lenders.

The site does charge an origination fee along with several other fees including check processing, late payments, unsuccessful payments and a collection fee if you default on the loan.

GreenNote

GreenNote is a little like ZimpleMoney in that you have to invite people to help fund your loan through social lending. The site focuses on student loans so I wanted to include it here for those looking to tackle their mounting student loan debt. It’s a good option for students that have bad credit or no credit at all because your FICO credit score really isn’t an issue.

Students and other borrowers can fill out a loan application including details on their academic and career goals. They connect their social networks to reach out to potential donors for their loan. This makes it much more a social crowdfunding idea rather than a loan.

How to Improve Your Chances of Getting a Peer to Peer Loan with Bad Credit

Since p2p loans are funded directly by investors rather than strict rules for bank lending, there are things you can do to improve your chances of getting approved. Peer lending websites usually have a minimum credit score for loans but a lot of your credit factors can help influence the platform and investors to get a better deal.

To do this, you only have to think like an investor. What is an investor looking for when they look at peer loan borrowers?

- No delinquencies or charge-offs in the last year, preferably none in the last six months.

- Less than 35% debt-to-income ratio, this means your monthly debt payments are less than a third of your total income

- Less than 50% credit utilization ratio, this means using less than half the max on your credit cards

- All past due balances are paid off

- Only borrowing as much as you need – I usually don’t invest in p2p loans over $15,000

Peer to Peer Loan FAQs

I realize p2p lending is still really new for a lot of people so you probably have questions about how it works and how to get the best deal. I’ve been writing about peer lending for a few years now and have seen all the most common questions but feel free to use the comments section below to ask away

How long does it take to apply for a peer to peer loan?

The application process on most peer lending sites takes less than five minutes and you get an approval in less than a minute. The p2p site will just need contact information and some employment information along with your social security number to check your credit score.

Peer lending sites are completely safe and use the same security protection as the big banks. They don’t keep your social security number in their system so you don’t have to worry about identity theft.

How long until I get my money from a peer lending site?

Most borrowers get their money within three days. About one in five borrowers need to provide extra documentation for their loan including paystubs or old taxes. Some borrowers will have their employment verified but this only takes a day or two.

The biggest holdup for most borrowers is not having those documents ready if requested. If you have the documents ready, there’s no reason you won’t get the loan in your checking account within a few days.

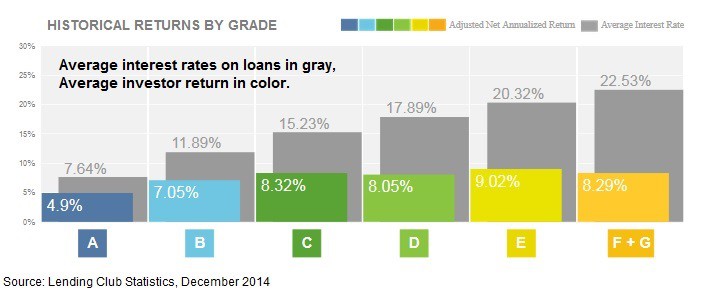

What are the interest rates on peer loans?

I’m not going to lie to you. Interest rates on peer to peer loans can be high, especially if you have bad credit. I paid 18% on my p2p debt consolidation loan after ruining my credit but it was still much lower than the 24% I was paying on credit cards.

Peer to peer interest rates start around 7% but can be as high as 36% for borrowers with really bad credit, like in the 500s FICO score. The thing is, even the highest rate is still lower than payday loans and cash advance stores. It’s also lower than the fees you’ll pay on bounced checks.

Can I still get a loan with bad credit?

Peer lending was made for people with bad credit. Banks stopped lending to people with poor credit after the financial crisis so somebody had to step up.

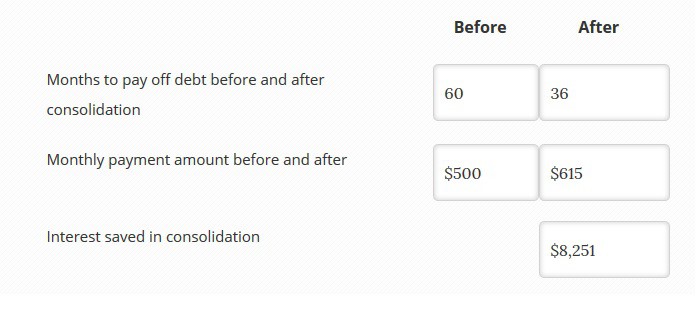

Even on higher rates, a peer loan can help you get control of your finances. Consolidating your debt not only makes it easier to manage and lowers your payments but helps boost your credit score.

What can I use a peer to peer loan for?

Peer loans are personal loans which means you can use the money for whatever you like. I’ve used p2p for a debt consolidation and for a home improvement project. I’ve talked to people that have used the loans for a wedding, a dream vacation and even as a down payment for a home.

Pros of Peer to Peer Loans and Platforms

- A last source of money for people with bad credit, rejected by banks and credit unions

- Rates below cash advances and credit cards

- Fast approval and money within a day or two

- Helps to improve your credit score with regular payments

- Fixed rates and payments make it easier to plan debt payoff

Cons of Peer to Peer Lending Sites

- Higher rates compared to bank loans

Ability to borrow up to $35,000 on most loan sites might tempt people to over-borrow

Summary Guide to Bad Credit Personal Loans Sites

No one peer loan site is best for all borrowers, especially bad credit loans that might have special requirements or borrowers with special needs. The ten bad credit personal loans and online loans providers above are my favorites for different reasons.

Some offer better rates if you can qualify on tougher credit requirements. Others offer the chance to get lower rates by asking friends and family to help out.

I’ve included some final thoughts on the best online loans providers for a few special circumstances like peer loans, cash advances, debt consolidation and student loans. Most online loans sites will run a soft inquiry on your credit to offer an interest rate on your personal loan. This doesn’t affect your credit score so you can apply to a couple of sites to find the best rate on your loan.

It’s only when you accept the loan terms that the lenders will run a ‘hard’ inquiry on your credit which will show up on your credit report.

Best Peer to Peer Loans for Bad Credit

Online peer to peer loans are really changing the way we get money and could put traditional banks out of business someday. These online loans cut down on lending costs by not having a physical bank location and can pass some of those savings to you through lower interest rates on personal loans.

PersonalLoans is first in line for these types of loans and a little more suitable for bad credit personal loans. The lower credit score requirement means most people qualify and there is also no pre-payment penalty. Loan rates will be higher but plan on paying your loan off early and it won’t matter as much.

I would also include BadCreditLoans in this list of best peer lending sites for bad credit. The lender limits loan size to $5,000 but will approve loans on a much lower credit score than any of the other sites. You might only get approved for a $1,000 loan on one-year repayment terms but it can be enough to get ahead of your bills while you build your credit score.

Best Online Loans for Cash Advance

If you need a quick cash advance, there are a few of the loan sites that can provide money faster than others.

NetCredit claims to be able to get a personal loan deposited in your bank account in as little as one business day but all my loans have taken a couple of days. That’s still pretty fast and usually the only thing that slows the process is if you need to find pay stubs or other documents for verification.

Best Online Loans for Debt Consolidation Loans

Lending Club and PersonalLoans.com both excel at debt consolidation loans. Last I checked, debt consolidation loans made up 80% of the loans funded on Lending Club. Investors love to fund these loans because you are paying off higher interest credit cards. You save money on interest payments and investors get a higher return for their money, it’s a good situation for everyone.

Payoff might be a better choice for people with higher credit scores and that can qualify on the site since rates might be lower. Even if you have bad credit and get a loan through Personal Loans.com, you’re still looking at a rate that is going to be lower than high interest credit cards so you’ll still save money on the loan.

Just make sure you don’t use the online loan to pay off the credit cards then rush out to go shopping. Debt consolidation loans should be used to get back on your feet and get out from under bad credit.

I recently created a debt payoff calculator to help you with your debt consolidation using a peer to peer loan. The calculator lets you see exactly how much you can save on interest and how much faster you’ll be debt free with a p2p loan.

Best Online Loans for Student Loans

Total student loans in America passed $1.3 trillion in 2015 and are rising faster than almost any other loan type. Besides being a burden on graduates with low starting wages, student loans could actually limit economic growth as young adults find they have less money to spend.

SoFi is the largest student loan refinance provider in the list thought it doesn’t qualify as a bad credit loan provider. The company doesn’t release the credit score you’ll need for a loan but I think it’s higher than nearly every other online loan site on the list.

Of course, its ability to pick and choose borrowers has also allowed it to offer some of the lowest rates on the list for personal loans and student loan refinancing.

GreenNote is a good alternative to SoFi for social lending if you can line up your own lenders through friends and family. It’s more of a social lending model which means your credit score won’t matter, a great option for students with bad credit or no credit at all.

Warning Signs of Bad Credit Personal Loans Scams

Having bad credit doesn’t mean you should be a target for personal loans scams but a lot of lenders prey on people with little other options. Understanding the warning signs of bad credit personal loan scam will help you from identity theft and destroying your credit on super-high interest.

- Personal Loan application fees are illegal. You should never have to pay for filling out a personal loan application form.

- Emails from Personal Loan Lenders that come out of nowhere are another warning sign. Be careful of those calls and emails for personal loan sites that you didn’t provide contact information.

- High pressure sales for personal loans. You have the right to look around for the best deal on a personal loan, especially bad credit loans. Anyone trying to push you into their loan is just trying to make a buck.

- Personal loan funding is not guaranteed. Any website that guarantees funding for your bad credit personal loan is probably running a loan scam. Many of the online lenders in the list can loan to almost any credit but they won’t guarantee it because it’s just not possible.

Alternatives to Peer to Peer Loans

I’ve been happy with my peer loan experiences and usually recommend them as a good way to get control of your finances. There are some instances when a p2p loan may not be the best choice. You might consider some of these peer lending alternatives depending on your situation.

Crowdfunding can be an option if you have a strong social network and are not afraid to ask for the money. Some crowdfunding loans may not have to be repaid while terms are pretty easy on others.

Bank loans can be an alternative if you have a few months to improve your credit score to the point where you qualify for a traditional loan. Any loan secured by your car or home will probably be cheaper but will come with the risk of losing the collateral if you can’t pay.

It’s always best to give yourself a few months to improve your credit score before taking out a bad credit peer loan. Increasing your credit score by just 30 or 40 points could save hundreds on loan interest and you won’t need a co-signer on your loan. A lot of times when you need a cash advance, this isn’t possible.

Use these bad credit personal loans sites in the meantime until you can build your credit score to get lower rates from other lenders. Make sure you check out the p2p lending comparison table to see which peer lending site is best for your needs and take advantage of the fact that there is no cost to apply for a peer loan. Don't forget to check out social lending if you think you can fund your loan through family and friends. The p2p application process won’t affect your credit score until you accept a loan so make sure you shop around for the lowest rate.

I have created a bad situation for myself as a result of gambling debt.I have taken out payday loans to cover it and now it seems like I’m working to just pay the interest on the loans and not getting out from under them. I’m seeking a $2000 to $3000 loan to help me get through and past this. I would appreciate any advice on which type of loan would be best to seek. My credit score is 579

Hi Richard,

Payday loans are the worst! I see so many people get trapped by recurring fees that amount to triple-digit interest rates. Your credit score is probably too low for some of the lower rate personal loan sites like Lending Club and SoFi but you might want to give it a try anyway. It doesn’t hurt your credit to apply and the rates on these sites do tend to be a few percent lower than bad credit personal loan sites. If you can’t get approved there, try Upstart and finally PersonalLoans.com for a loan. The last site there is really the best for personal loans on bad credit. They give you a few options for types of loans and you shouldn’t have trouble getting approved. The loan you’re looking for is fairly small which should help.

Hi, I recently paid off some collections and I’m in the process of making sure it shows paid on my credit report. I was in a car accident on 11/3/17 & after paying my $500 deduction & car rental, I fell behind in paying my mortgage. My bank would not agree to a modification in that it would increase my mortgage amount. I need $5000 but my credit score is 568. I’ve been at my current job for almost 14yrs and I’m also trying to clean up my credit. What P2P loans for bad credit would you suggest for me. Thanks!

Since it doesn’t hurt your credit score to apply, I would try at least a few peer-to-peer loan sites to see which one offers the better rate. It will only go on your credit report after you accept a loan. With your credit score you’re probably not able to get a loan from Lending Club or SoFi but should be able to use Personalloans.com or NetCredit and maybe Upstart. Remember to apply for only the amount you need and try to pay it off as soon as possible.

I am a single mom of two boys I am looking for a loan of $5000 asap as I have come into some financial difficulties I am currently waiting for disability so I just have my child tax at the moment but I am able to make small monthly payments to repay the loan and when I get my disability I should be able to pay off the balance remaining

Hi Amanda. Most of the peer to peer loan sites in the list will deposit your loan within two or three days so I would try there first. There are a few sites that promise same day or cash in 24 hours but it’s usually a couple of days after you fill out the application.

I like to no if I can get aloan for 5000 right away I’m on disabilty I need it for aleast two month then I’ll pay it off

My husband and I have just begun to rebuilt our credit. After years of not needing it, using it, or having any scores (he) to speak of, myself mid 600s with two of three bureaus reporting, still means nothing with one P2P. My Q: which P2P would work best for our situation for a $3500 loan we can pay back to help purchase a vehicle (the other half from a long-awaited tax refund from amended returns.)? Crowdfunding wouldn’t help; we have few family members to assist and I’m squeamish to ask the public to fund us. If we have to go one of these routes, what would be the best period of time to wait to build a decent FICO score to resubmit a P2P application?

I’m trying not to cry from frustration and anger; the vehicle we have now is almost on borrowed time. And in a state with limited public transit, not having transportation means isn’t an option. Many thanks in advance.

The good thing about personal loans and p2p is that you can apply to a few without hurting your credit score. They all do soft inquiries which are like pre-approvals so you can find your best deal. I would look at PersonalLoans, Lending Club and Net Credit.

My job was “eliminated” about nine months ago. My cushion is now completely gone and I’ve sold all of the valuables I had. The good news is I finally got a job that will pay well, but I don’t start for several weeks and my first paycheck will be at least a month and a half from now. I’ve already exhausted all family charity so social platforms are not an option. While it’s possible to get loans with bad credit as well as loans when unemployed, so far I’ve found it’s impossible to get any type of loan with both going against you. I had a decent amount of money coming in from family regularly after severance and my cushion ran out. Could that history be used in place of pay to help me find other options? I already have two personal loans from Lending Club to consolidate debts years before I lost my job. I’m in limbo now and I can’t make it without financial help. I don’t have any co-signer options available either. Any advice would be appreciated!

It’s a tough spot Robyn. Your best bet might be just to get a quick part-time job to make sure you keep up with the bills and don’t hurt your credit until you are able to get a personal loan.

Which FICO score is used? Here’s my Experian FICO scores: FICO Score 8: 614; FICO Score 2: 654; FICO Auto Score 8: 632; FICO Auto Score 2: 653; FICO Bank card Score 8: 619; FICO Bank card Score 3: 691; Bank card Score 2: 620.

My Equifax: FICO Score 8: 597 (and there’s several errors but it’s difficult to get them fixed on Equifax!!

My TransUnion: Score 8: 619.

Can you please tell me what’s my FICO score as far as personal loan lenders are concerned?

By the way, your website is so informative! I’m learning so much! Thank you!

From what I’ve seen, TransUnion is the most popular credit bureau used among personal loan sites but Experian and Equifax get used as well. Sometimes you can find which credit bureau a lender will use with a Google search. If nothing else, try applying on a few personal loan sites. You have the right to see your credit report if denied the loan so you’ll be able to see which FICO they used.

I’m waiting to hear back from a lender who is reviewing my application. In the meantime, I have a couple of questions:

1-In the short application with a lender-finder like Personal Loans, etc, one of the questions is what is your source of income? You can only choose one, such as full-time employment, or self employed, or fixed income or benefits.

What if you are like me? I am employed and paid a salary. I also have a yearly benefit that is substantial. And, I am also self-employed. All three add up to a decent income. But just listing one of them pretty much cuts my income down by about 40-45%. This is just the initial seach for pre-approved offers. But in submitting these apps, I haven’t been getting too many offers and it’s possibly because my income listed is on the low side, and that’s not correct. Should I list one job, for example the salaried one, but add the combined incomes together to give a better picture of my true income? Or is that fraudulent because my salary is not that high?

2- How many of these lender-finder sites should I apply with at the same time? If a lender is reviewing my application, would it be a bad move to apply with other lenders while I am waiting for their decision? I understand a soft pull doesn’t do anything negative, but what about when I want to apply with 3-5 lenders at once? Will each hard pull affect my chances with all the lenders I apply with until my score is so low that no one will give me a loan? Each hard pull can take 5 points off my score, and just two pulls is 10 points on a marginal score. How does this work? Thanks!

Good questions. I would add all your income together and list it as employed income. If they ask for verification, that’s when you come out with the pay stubs and self-employed verification but they usually don’t ask to verify. I would apply to at least 3 loan sites and maybe more. Even for hard inquiries on your credit, getting multiple at once doesn’t hurt your score as bad because FICO knows you’re just shopping around.

Hi There,

I’m a single mom of 3 and one of my children is disabled. My Experian FICO is roughly 571, Transunion is 529 and Equifax is 478. My vehicle finance company reports to Experian so I think that’s why its higher. Most of my debts have been paid off but my score wont seem to go up. I was attending school and my son got very sick (the disabled one), thus resulting in me missing classes and getting denied my second disbursement of student loans. It was my rent money and utility funds. I was able to get a loan through a credit union to cover the utilities but I’m trying to not get evicted. Ive tried everywhere. Most of the P2P lenders wont consider my because of the low scores. I literally only have a vehicle financed and 2 secured credit cards. I don’t know where to go. Any advice is welcomed. I live in AZ so payday loans are not an option. Thanks

One thing that usually helps boost bad credit is to get your monthly rent added to your credit report. Great way to build good credit if you don’t have a lot else that goes on your report. Might still be able to get a loan from personalloans or netcredit, otherwise might have to wait a few months to get your FICO higher.

Hi. I am beyond desperation and don’t know where to go. I used to have good credit. Last year, I got sick and missed two months of work on leave without pay. I went back to work but missed a lot due to illness. My dog also got sick so we had high vet bills. Currently, I am so far behind in everything. Since my credit is so bad (I have been sued by two different places and my paycheck is garnished but at least the bill is getting paid) I don’t qualify for a loan. Even the Guaranteed places say no. I need about $5000 to pay everything up to date and just have one payment. My family has no money and I have no where to turn. Do you have any suggestions? Thank you.

It’s a bad spot and I’m sorry to hear. There won’t be many personal loan sites available with the current delinquencies on your credit. Might try NetCredit but it might not approve either. Best you can probably do is start negotiating with creditors to pay off part of the debt and get it wiped from your report before they force you into bankruptcy. Will take a year or two but you’ll be able to get back on your feet.

Thank you, this has been extremely informative. You have the best laid out article that I have read thus far. My scores are: 673 transunion, 668 equifax, and 606 experian. It is always surprising how different these scores are. I would like to get a loan for about $25,000 – $30,000 and pay it off in two to three years max. What would you recommend?

You’ve got a good credit score on TransUnion so shouldn’t be a problem getting approved. Apply on a few of the sites in the list, start with SoFi and Upstart because they usually offer the best rates. If you don’t get approved there, try PersonalLoans.com and a couple of the others.

Hello, I am an 18 year old college student. I am currently trying to find a way to pay for next semester but none of my family members can afford to cosign a loan for me and I have zero credit history. My federal loans only cover half of my tuition. My only way to pay for it now would be to try and find a bad credit personal loan. This is very unfortunate because I have dreamed of going to college to pursue the medical field. What personal loan company could I try? and what would my options be?

I need a loan to help me cover move in costs for my new apartment I live on disability and I cant afford to pay a 3000 move in cost on my own but I need at least 5 or 6 thousand to help me move and stock my new kitchen with food and pay off my 800 dollar eletric bill need help but have no credit history