Try these credit score hacks to boost your credit score before getting a loan

It may not seem like it most of the time but your credit score is one of the most important parts of your financial life. Whether you use credit or not, nearly everyone needs a loan at one point or another and bad credit can destroy your financial plan.

Trying to boost your credit score won’t happen overnight so it’s best to plan ahead and increase your credit score over time.

But there are a few tricks you can use to increase your credit score quickly. These credit score hacks won’t boost your score hundreds of points but they can help to add 20 or 30 points to really lower the rate on your loans.

Before getting into my three favorite credit score tricks, let’s look at what your credit score means and how it’s determined.

What is a Credit Score?

Your credit score is supposed to represent how much of a credit risk you are on a loan. It is a number between 300 and 850 though I’ve never seen a score below 500 or one above 820 FICO.

Three credit reporting agencies gather all the information about your current loans and other debt to create your credit report. Your credit report stays with you for as long as you live but information drops off over time. Apply for a loan and the application inquiry will be on your report for six months. Miss a payment or default on a loan and it could be on your report for up to ten years.

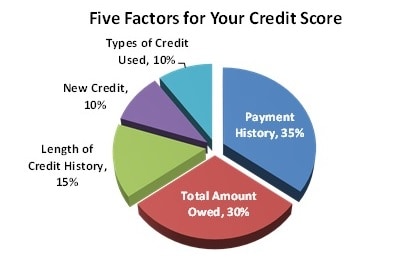

When you apply for a loan, your credit score is determined off of one or more of these credit reports. There are five factors that go into determining your credit score.

- Payment history is the biggest factor and is just a record of your on-time or late payments on debt. There’s really not much you can do about it except decide to make monthly payments on time in the future.

- Total amount owed is another big factor and includes how much you owe compared to your income and compared to how much credit you have available. You might not be able to change how much you make quickly but you can change your credit available to help boost your credit score.

- Length of credit history is another one that you’re not going to change. It’s just the amount of time since you had your first credit account or loan. Don’t wait until you’re 35 and need a home loan to start building your credit!

- New credit is a small part of your score but one you can change to boost your credit score. This is the amount of loans you taken out recently and the number of times you’ve applied for credit. If you are planning on asking for a loan soon, don’t open any new credit card accounts or ask for any loans beforehand.

- Types of credit is primarily the difference between revolving and non-revolving debt. Revolving credit is the amount of credit card debt you have on your report. It’s ‘revolving’ because you can keep borrowing and there is no payoff date on the loan. Non-revolving debt is stuff like a mortgage or auto loan which gets paid off in time.

Three Credit Score Tricks that Work

It will take at least a couple of months to start seeing your credit score increase even with the best credit score hacks. You’ll need upwards of six months to see a real boost in your credit score but even a 100-point FICO change can mean saving thousands in interest on a loan.

These three credit score tricks aren’t the only ones you’ll want to use before trying to get a loan, just the fastest. Watch this video for five more of my favorite credit hacks.

1) The easiest and fastest way to boost your credit score is to get lenders to increase your credit limit. Call customer service for your credit cards and ask to increase your limit. This isn’t a license to spend so don’t rush out to do any shopping. The reason this works is because it improves your debt-to-available credit ratio, a measure of how much debt you have and how much is available. Someone with $2,000 on a maxed out card looks like a bigger credit risk than someone with charges of $2,000 on a card with a $5,000 limit.

2) Another credit score hack is to consolidate your debt through a personal loan. There are several personal loan sites (check here for the top 10 loan sites) but PersonalLoans and Lending Club are usually the best option for lower rates or loans on bad credit. You take out one loan to pay off higher interest credit cards and then make the single monthly payments instead of multiple bills.

Consolidating your debt not only helps to increase your credit score but can save a lot of money in interest. It improves your credit score by decreasing the amount of ‘revolving’ credit on your reports. Your personal loan will go on your report as ‘non-revolving’ debt since it has a payoff date. It will also help to improve your credit available measure as well since you won’t be maxed out on your credit cards. Don’t close your credit card accounts after paying them off but don’t rush out to spend more money either.

- PersonalLoans will accept borrowers with a FICO score of 580 or higher and doesn’t charge an origination fee.

- Lending Club may be able to offer lower rates on peer to peer loans, starting around 7% for borrowers with good credit, but they only make loans for borrowers with a 640 credit score or higher.

Check your rate on a consolidation loan up to $40,000 – won’t affect your FICO

3) The Debt Snowball is one of my favorite ways to pay down debt and a good way to increase your credit score fast. It’s not really a credit score hack but a different way to pay debt that keeps you motivated to stick to your budget. The idea is to rank all your monthly loans or credit by the total amount left to be paid, from smallest to largest.

You still make the minimum payments each month but put any extra money to paying off the smallest loans first. Since you’re starting with the smallest loans, you’ll pay them off quickly.

It’s so motivating to start seeing debt drop off your list and you’ll look forward to checking the list each month. Pretty soon, your credit score will start increasing because you’ll have fewer credit accounts and less debt owed.

Personal Loan Hacks that Work

If you decide to get a personal loan or consolidate your debt, there are a couple more loan hacks you can use that help get more from your money. These three money tricks will not only help you reach debt free faster but will save you money and build your credit score.

Loan Hack #1 is to make more frequent payments on your remaining debt. A lot of credit and loan servicers calculate your interest by the average daily balance. That means making one big payment at the end of the month won’t save you much money because of all those other days you carried a higher balance.

Instead, break up your monthly payment into a few chunks and make a payment every couple of weeks or more. Even though you’re paying the same total amount, this will reduce your average daily balance and the amount of interest you pay. Of course, if you can, it also helps to put a little extra on the payment each time.

Loan Hack #2 is to use a balance transfer to a new credit card to get a lower introductory rate. This works great if you aren’t able to get a debt consolidation loan or if you just want to wait before getting a personal loan.

Transferring your credit card balances to a new card with a 0% introductory rate for even six months can save hundreds in interest. Don’t let up though. Keep putting as much to your card payoff as possible and pay the debt off faster.

Loan Hack #3 is to pay your insurance premiums once a year instead of every month. Insurers allow you to pay your premiums monthly but they also charge you for the convenience, usually about 8% more on top of what the annual amount would be.

Call your life, health and car insurance to ask about switching to an annual premium payment and how much will it decrease the payments. This is a great time to shop around for a better rate as well. Write down the quotes from three or four insurers and tell your current agent that you’re shopping around for better rates. Not only will you save on the annual payment but you’re likely to get a better rate.

How to Win the Credit Score Game for Quick Loan Approval

These three credit score hacks are your best way to increase your credit if you don’t have any missed payments or loans in collection on your credit reports. If you have really bad credit from any of these, your best bet is to dispute claims and negotiate with your creditors. This will help get the worst stuff cleared from your credit and you can start with the other credit score tricks.

The best way to win the credit score game is to give yourself plenty of time to build your FICO and be super-protective of your score. It sucks that you can go years of on-time payments, watch your score jump higher and then one or two missed payments send you back to the start but that's just how the game is played.

Understand what is and what is not on your credit report to really be able to focus on the things that matter. I've also created a detailed credit score guide that shows the average FICO score, what happens to your score when you miss a payment and other pointers on increasing your score.

Some credit score hacks will help you boost your score just long enough to get a loan but they aren't a long-term solution to bad credit. There's no trick to good credit, it's just something you have to work on by building good spending habits. Set your bills on automatic payment and consider a consolidation loan to put everything on one account. Pretty soon, you'll have excellent credit!

I need some assistance getting out of debt. . .my situation went bad quickly and I am desperately trying to get a handle on my situation, not to file bankruptcy. . .HELP PLEASE

Avoid bankruptcy if you can, it will destroy your credit and stay on there for up to 10 years. I would consider a debt consolidation loan to lower your payments and dig yourself out.

Is there any reason that you could not consolidate debt?

Could not or should not? You shouldn’t consolidate debt if the personal loan rate is higher than the rate on your debt. As for could not, I’d say your credit score is the biggest factor here.

I have a bad credit and want to consolidate my loans in order for me to have some breathing space. The irony of the matter is, I live in Papua New Guinea and most of the P2P lending sites do not offer loans to this part of the country. Please need help urgently if there is a P2P lender out there that is able to assist.