This Lending Club review will clear up any confusion about peer loan sites and p2p lending

There’s been a lot of news lately about Lending Club and other peer loans sites so I thought I would update with a Lending Club review to clear up any confusion. I’ve used Lending Club loans once in the past as well as a few other peer to peer lending sites. Lending Club offers lower rates but stricter credit score requirements.

The higher credit score requirements are the biggest Lending Club complaint I had in my review. My credit wouldn’t have qualified in the past though I’ve increased my score and was able to get a loan more recently.

It doesn’t affect your credit score to check your rate on a peer loan so you should try Lending Club peer lending before some of the bad credit peer lenders. If you get denied for a Lending Club loan, check out this list of best bad credit peer loans online.

Check your Rate on a Lending Club loan first to save on interest

What is Lending Club?

Lending Club wasn’t the first peer to peer loan site but it is the largest providing more than $18 billion in loans to borrowers and small business. Founded in 2007, Lending Club issued shares on the New York Stock Exchange in 2014 and has more financial capital than smaller peer loan sites to really move the market.

Like other peer loan sites, Lending Club is an online lender providing unsecured personal loans. The site also offers small business loans but it’s a very small portion of the total loan volume. Loans of up to $40,000 are available on terms of 3- to 5-years with month payments. Peer loans are unsecured, meaning you do not put up collateral like your home or car to get the money.

Once your loan is approved and you accept the terms, it goes on the site where investors bid to fund it. Investors won’t see your personal information, just the rate on your loan and some basic credit information. Most loans are funded within a few days and the money is deposited directly in your bank account.

We’ve reviewed peer loans on the site before and compared the two major loan sites, Lending Club and Prosper, in a side-by-side comparison in this peer to peer lending review.

How to Get a Loan on Lending Club

Getting a loan on Lending Club, or really any peer loan site, is fairly quick and easy. You’ll first be asked for basic information like your credit score and how much you need. The system can pre-approve you in less than a few minutes and give you an estimate of your credit score on the loan.

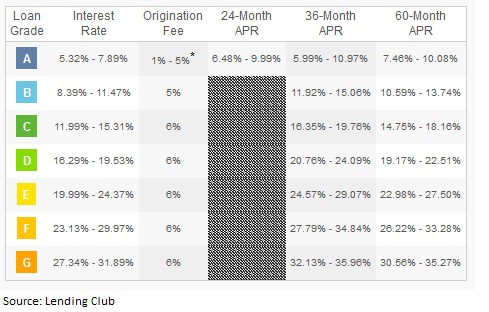

Once approved, you will get full detail on your loan before you accept the money. Depending on your credit score and other factors, your loan will fall into one of seven risk categories that will determine the interest rate. Rates start as low as 5.32% plus the origination fee and range as high as 31.9% for bad credit loans.

Even on loans with higher rates, borrowers still report saving on interest compared to high-interest credit cards. It’s one of the reasons why debt consolidation loans make up the majority of peer loans on Lending Club, refinancing to pay off the higher-interest debt.

There are a few things to remember before you get your loan to get the lowest rate possible.

- Longer-term loans will have higher rates but lower payments. If you can afford a three-year loan then you will be able to save on interest payments.

- Smaller loans are cheaper than larger loans so only borrow what you need.

- If you don’t need the money immediately, try improving your credit score with these credit score hacks that can work in just a few months.

Lending Club Peer Loan Fees

Besides the interest rate on your Lending Club peer loan, there are some other fees you need to understand. It’s always free to check your rate and won’t affect your credit score but the site does charge fees for origination and late payments.

Lending Club will send you an email reminder each month before your payment is deducted from your checking account. You are allowed a 15-day grace period after your due date but if you go later than that or if there are insufficient funds in your account, you will be charged a fee. Lending Club charges a $15 unsuccessful payment fee and a fee of 5% on your remaining balance for late payments.

While most people pay for free using automatic debits from their checking, you are allowed to pay by physical check though there is a $7 processing fee. These fees are all pretty standard for peer loans sites.

What I like about Lending Club

With its status as one of the few publicly-traded peer lending sites and the largest p2p lender in the world, Lending Club has the financial power to change the market for loans. Smaller banks have all but turned off the tap for consumers and small businesses over the last few years so it’s good to see a startup like Lending Club fill the need.

- If you qualify for a loan, rates are lower than other peer to peer loan sites. Personal loans of up to $40,000 start at an APR of 5.99% including the origination fee.

- The application process is fairly quick and may not need verification. Money is available within a few business days

- The site is not only a good opportunity for borrowers but investors have found a whole new asset class in peer loans for higher returns and less risk.

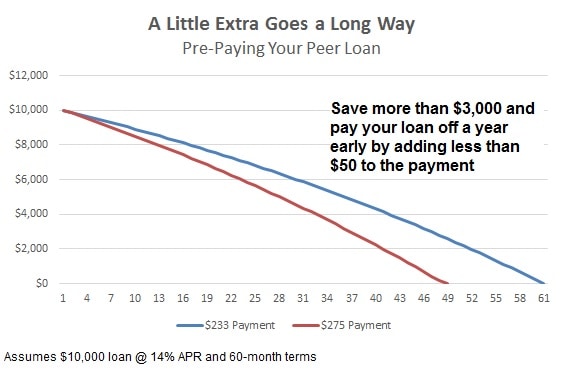

- One of the best features of Lending Club loans, and really all peer loans, is that you can prepay your loan to save on interest. There is no pre-payment penalty so adding a little extra each month can pay off your loan sooner with no extra charges.

For example, your payment on a five-year loan for $10,000 at 14% would be $233 per month. Adding less than $50 a month to your payment ($275) would save you $3,100 and your loan would be paid off in four years.

Lending Club Complaints

The biggest complaint I’ve heard from borrowers is the higher credit score required to get a loan. While there is some leeway for repeat borrowers, most will need a FICO score of 660 or higher to get a loan on Lending Club. That locks a lot of people out of the platform which is too bad because rates are lower compared to other peer loan websites.

The peer loan site got tripped up earlier this year on news it was changing information on some loans for one investor. The news led to the firing of the founder and several executives but doesn’t really affect borrowers. Lending Club counts several financial heavyweights on its Board of Directors including former Secretary of the Treasury Larry Summers and Morgan Stanley Chairman John Mack. The new CEO has been working to restore investor confidence in the company and borrowers are still seeing quick funding for most loans.

Lending Club Peer Loan Review Summary

As far as peer loans go, Lending Club is one you should check before you apply on other sites. There is a chance that you might not get approved if you have bad credit but it doesn’t hurt your credit to check your rate and it will likely be lower compared to other peer loan websites if you get approved.

Check your rate on Lending Club and Get Approved Today

Recent news around Lending Club doesn’t affect borrowers though the peer loan site has said that it will be tightening credit standards. Rates are still low and there are no penalties for paying off your loan early. Taking out a consolidation loan may help improve your credit score, making Lending Club a financial tool you don’t want to miss.

Leave a Reply